lead-pro-100.online

Community

Bank Of America Id Requirements

All banks and credit unions are required by federal law to collect information about people opening financial accounts to verify identity. · Ensure you have a. Personal information. This usually includes your foreign and U.S. addresses, date of birth, country of citizenship and occupation. Primary ID. Typically you'll. You'll need to provide both a foreign and U.S. address, as well as two forms of ID and a tax identification number. Proof of home or permanent residence address. Instead of your SSN, they'll ask for an Individual Taxpayer Identification Number (ITIN) and other documents. As long as the necessary requirements are met, you. ID is locked, enter your User ID below and select Continue. Continue Bank of America Corporation ("BofA Corp."). MLPF&S is a registered broker. Registration also requires the setup of a user ID and password, which the cardholder must create and memorize. Can I register my personal Bank of America credit. To change your legal name or legal title: Please bring a government-issued photo ID plus any additional documentation specific to your situation to any Bank of. Name and address of business · Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-. A valid government-issued photo ID · One of the following: marriage certificate, divorce decree indicating name change, court order of name change or adoption. All banks and credit unions are required by federal law to collect information about people opening financial accounts to verify identity. · Ensure you have a. Personal information. This usually includes your foreign and U.S. addresses, date of birth, country of citizenship and occupation. Primary ID. Typically you'll. You'll need to provide both a foreign and U.S. address, as well as two forms of ID and a tax identification number. Proof of home or permanent residence address. Instead of your SSN, they'll ask for an Individual Taxpayer Identification Number (ITIN) and other documents. As long as the necessary requirements are met, you. ID is locked, enter your User ID below and select Continue. Continue Bank of America Corporation ("BofA Corp."). MLPF&S is a registered broker. Registration also requires the setup of a user ID and password, which the cardholder must create and memorize. Can I register my personal Bank of America credit. To change your legal name or legal title: Please bring a government-issued photo ID plus any additional documentation specific to your situation to any Bank of. Name and address of business · Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-. A valid government-issued photo ID · One of the following: marriage certificate, divorce decree indicating name change, court order of name change or adoption.

This form of identification verifies who you say you are by allowing the bank to match up your face to your name. You can bring your driver's license, state. Deposit checks from almost anywhere with the Bank of America Mobile Banking app Footnote[1] on your smartphone or tablet. Two, it may be recognized as a fraud because I made a purchase with my Bank of America credit card through PayPal for $ Anyway, I called. Your driver's license, passport or other government-issued ID card; Social Security number or Individual Taxpayer Identification Number (ITIN); A blank check. Need help accessing your Bank of America account? Find your account number, hours, withdrawals, scheduling and more with these frequently asked questions. Shanghai, China | Bank of America, National Association Shanghai Branch. 55th Floor, International Finance Center, Tower 2. Depending on the policies of the financial institution, you may be required to provide additional documentation such as proof of address, Social Security number. Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are Bank of America honors any opt-out preference signal that meets legal requirements. You'll need to provide official, government-issued photo identification. Many of these requirements may be familiar to U.S. citizens as well. Some financial. TWO (2) Forms of ID Required for all Financial Transactions. (One must be A Bank issued card with photo. Employment Authorization Document with photo. [Bank of America login screen appears, and Face ID unlocks]. On screen Data connection required for online and mobile transfers. Wireless carrier. Provide the following information to begin your enrollment. Card or Account Number (Last 6 digits) Social Security Number (SSN) or Tax ID Number (TIN). Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review. ¹ Zelle transfers require enrollment and must be made from a Bank of America iPhone, iPad, Touch ID and Face ID are registered trademarks of Apple®, Inc. A valid, government-issued photo ID like a driver's license, passport or state or military ID. Open a new Bank Smartly® Checking account and complete required. Name; Date of birth (for an individual); Address; Identification number. The required identification number for a U.S. citizen is a Social Security number and. For eligible accounts, Bank of America automatically provides an electronic version of current and past paper account statements through Online Banking. Proof of Identification. You'll likely need some information from a government-issued ID, like a driver's license, state ID, or passport. · Employment. You'll need to bring acceptable ID as required by your state along with all pages of the document being notarized. Before you schedule your financial center. Data connection required. Wireless carrier fees may apply. 7. We will waive the $8 monthly maintenance fee on the Bank of America Advantage Savings account each.

How Do I Get A Loan For A Manufactured Home

This program insures mortgage loans made by private lending institutions to finance the purchase or refinancing of a new or used manufactured home. We finance manufactured homes which are often still called mobile homes. Florida mobile home financing or manufactured home financing. You can buy a manufactured home with a loan insured by the Federal Housing Administration (FHA). These loans are available to finance the purchase of a. At First Alliance Credit Union specializes in providing affordable financing options for Manufactured Homes to the Rochester MN area. Apply online today. Mobile home loans in Michigan are tough to come by. Riverbank Finance offers low fixed rates for your Michigan mobile home loans. Check out the listings below to find a lender in Michigan that can help you find the right manufactured home loan. State Employees Credit Union (lead-pro-100.online) finances land-home purchases for manufactured homes across U.S. at lower interest rates with lower. RMHA's members include manufactured home lenders in Colorado. If you need financing for your manufactured home, they can help! SONYMA Manufactured Home Loans. Page 2. For New Yorkers who want to own a manufactured home, SONYMA offers a mortgage program just for you. SONYMA's Achieving. This program insures mortgage loans made by private lending institutions to finance the purchase or refinancing of a new or used manufactured home. We finance manufactured homes which are often still called mobile homes. Florida mobile home financing or manufactured home financing. You can buy a manufactured home with a loan insured by the Federal Housing Administration (FHA). These loans are available to finance the purchase of a. At First Alliance Credit Union specializes in providing affordable financing options for Manufactured Homes to the Rochester MN area. Apply online today. Mobile home loans in Michigan are tough to come by. Riverbank Finance offers low fixed rates for your Michigan mobile home loans. Check out the listings below to find a lender in Michigan that can help you find the right manufactured home loan. State Employees Credit Union (lead-pro-100.online) finances land-home purchases for manufactured homes across U.S. at lower interest rates with lower. RMHA's members include manufactured home lenders in Colorado. If you need financing for your manufactured home, they can help! SONYMA Manufactured Home Loans. Page 2. For New Yorkers who want to own a manufactured home, SONYMA offers a mortgage program just for you. SONYMA's Achieving.

There are many mortgage options for manufactured homes (formerly “mobile”), but there are special criteria to meet first. FHA loans are available for financing or refinancing manufactured homes with terms of up to 30 years and loans that offer low down payments and loosened credit. We offer a variety of mortgage loan options whether you are buying or refinancing a mobile home in a park. We offer attractive terms and competitive rates. Have you bought before but had your credit score take a slide with the recent recession? Then Texas Built Mobile Homes is the place for you to find a team. Financing for a manufactured home is available through an Adjustable Rate Mortgage (ARM), a Fixed-Rate Mortgage or our First-Time Homebuyers Loan. The maximum. Check out the listings below to find a lender in Kentucky that can help you find the right manufactured home loan. National Exchange Bank & Trust is one of the few financial institutions in Wisconsin to provide financing for manufactured homes. CHFA offers FHA (k) Renovation Mortgage Programs. Learn about the program's benefits, eligibility requirements and more. Find a list of approved lenders. Capital Home Mortgage Texas can help you with Texas Manufactured Home Loans! As a Texas Manufactured Mortgage Lender we have the experience to hep you navigate. We're your trusted lender for mobile home loans and manufactured home mortgages. Explore our comprehensive financing guide. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners. Manufactured homes consist of factory-built homes that have been engineered and constructed in accordance with the federal building code. Manufactured home loans can be an excellent option for first-time homebuyers due to their affordability, flexibility, and government programs. NHA's members include manufactured home lenders in Washington. If you need financing for your manufactured home, they can help! Manufactured Home Loans A Manufactured Home is a one-unit dwelling built on a permanent chassis in accordance with the National Manufactured Construction. BankWest Mortgage provides manufactured home loans to finance a home only, or land and home, in South Dakota and surrounding states. Under the Georgia Residential Mortgage Act, the Department has jurisdiction over a loan secured by a manufactured home. Welcome Home Loans are long-term, fixed-rate mortgage loans for manufactured-homes. They are unique because of the low downpayment, no age limit on the home. Manufactured Home Mortgage specializes in California Mobile & Manufactured Home Loans. We finance Mobile Homes In-Park and On-Land. WHA's members include manufactured home lenders in Wisconsin. If you need financing for your manufactured home, they can help!

Getting Loan For Home Improvement

A home renovation loan allows you to roll the costs of repairs or upgrades into refinancing your current mortgage, or into the mortgage for the home you buy. A loan for home improvements can unlock potential in your property and provide the funding for desired upgrades. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. The USDA also has a program designed to help borrowers pay for remodeling a home. Since USDA loans are intended for people who otherwise wouldn't get a mortgage. You do have options when it comes to financing, though, including home equity, refinancing, an FHA home improvement loan, a credit card, or a personal loan. Unsecured loans require a construction bid or documentation of materials to be purchased but do not add a lien to your property. An unsecured loan is great for. Fixer-upper loans — also known as renovation loans — are mortgages that typically offer you enough money to buy a new home and pay for repairs at the same time. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. As for options, HELOC, home equity loan or cash out refi. Yes rates are higher right now than they have been for a while, there's nothing you. A home renovation loan allows you to roll the costs of repairs or upgrades into refinancing your current mortgage, or into the mortgage for the home you buy. A loan for home improvements can unlock potential in your property and provide the funding for desired upgrades. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. The USDA also has a program designed to help borrowers pay for remodeling a home. Since USDA loans are intended for people who otherwise wouldn't get a mortgage. You do have options when it comes to financing, though, including home equity, refinancing, an FHA home improvement loan, a credit card, or a personal loan. Unsecured loans require a construction bid or documentation of materials to be purchased but do not add a lien to your property. An unsecured loan is great for. Fixer-upper loans — also known as renovation loans — are mortgages that typically offer you enough money to buy a new home and pay for repairs at the same time. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. As for options, HELOC, home equity loan or cash out refi. Yes rates are higher right now than they have been for a while, there's nothing you.

Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. When people talk about home improvement loans, also referred to as home repair or renovation loans, they can be talking about personal loans. This type of loan. How to Get a Home Improvement Loan · Consider your eligibility. Generally, you'll need at least a FICO credit score to be approved for a home improvement. This loan features: Borrow up to $25k. Repayment terms up to seven years. Your home's equity is untouched. How to finance home renovations · Must use an approved lender · Must pay insurance premium of 1% per $ of loan amount annually · Repair types may be limited by. Home improvement loans help you fund your home renovation projects. They're structured like traditional loans, so they don't require equity in your home. A home improvement loan is a way to finance home renovations. You typically get a home improvement loan by borrowing against the value of your home's equity. Whether you need to make necessary repairs or simply want to update your home, a Fix Up loan may be able to finance most home improvement projects for eligible. Qualifying homebuyers and homeowners can make renovations and additions to their home with one simple loan that covers both the mortgage and the renovation. Home Renovation Loans · Purchase a fixer-upper or refinance for renovation with a mortgage from WesBanco. · Get Started Today! · Find a Location Near You! · Get in. Use a Rocket Loans home improvement loan for quick funding from $ - $ for your next project, no collateral needed. Apply today to see your rate. A home improvement loan is like a personal loan in that it is an unsecured (no collateral) loan that can be used for home renovations, repairs, and/or home. 3 quick steps to get your Home Improvement Loan · 1. Check your rate. Securely share your basic financial information to see what interest rate you may qualify. You can save thousands in interest by using a Home Equity Loan or HELOC to fund your renovations, versus using an unsecured loan or line of credit. Discover home improvement loan options to upgrade your home. Get expert advice and tips to secure the best type of loan for your needs. Image. Before & After: a. Our home improvement loan is an unsecured loan—meaning your home equity, or anything else, is not on the line. Absolutely No Fees required. Surprises are almost. More Lending Options · Personal Loan · Home Equity Line of Credit (HELOC) · Home Equity Loan. Home renovation loans can either be an important tool for leveraging value-adding projects or provide you the means of getting emergency repairs taken care of. Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. Find the perfect home improvement loan: · Get the cash you need by refinancing your existing mortgage · Tap into your home's equity with a Home Equity Loan or.

Can I Open A Bank Account Online Td Bank

Can you open a bank account online? Yes, it is possible to open a bank account online. You may be required to provide some personal and financial information. You can open either one of TD Bank's savings accounts online. 1. Go to TD Bank's Savings Account Page. From the homepage, navigate to the bank's savings account. In this article, we'll show you what you need to open a checking account online, how to do it, and what some of the benefits are. Opening a TD Bank account is a breeze. You'll need some basic info handy like your Social Security number, a valid ID (like a driver's license or passport) and. The Balance Reporting Service lets each individual user rename the company's TD Bank accounts to a name that is more meaningful to them. Bank anywhere, anytime with the TD Bank app for personal and business accounts. The TD Bank app has a fresh new look that makes banking more convenient than. Open an account online now or visit your local TD Bank. Here's what you'll need to open your account. If you are a current TD customer you can apply for eligible products and services online through EasyWeb. From your My Accounts page that appears when you log. How to open a TD Bank checking account online. Easily and securely open a TD Bank Checking account from your desktop computer, tablet or mobile phone. Start! Can you open a bank account online? Yes, it is possible to open a bank account online. You may be required to provide some personal and financial information. You can open either one of TD Bank's savings accounts online. 1. Go to TD Bank's Savings Account Page. From the homepage, navigate to the bank's savings account. In this article, we'll show you what you need to open a checking account online, how to do it, and what some of the benefits are. Opening a TD Bank account is a breeze. You'll need some basic info handy like your Social Security number, a valid ID (like a driver's license or passport) and. The Balance Reporting Service lets each individual user rename the company's TD Bank accounts to a name that is more meaningful to them. Bank anywhere, anytime with the TD Bank app for personal and business accounts. The TD Bank app has a fresh new look that makes banking more convenient than. Open an account online now or visit your local TD Bank. Here's what you'll need to open your account. If you are a current TD customer you can apply for eligible products and services online through EasyWeb. From your My Accounts page that appears when you log. How to open a TD Bank checking account online. Easily and securely open a TD Bank Checking account from your desktop computer, tablet or mobile phone. Start!

You can easily apply online at TD Bank and open an account in minutes. If you'd like to talk to a TD banking specialist, they're available to assist you at 1. Enroll a Personal Account, Small Business Accounts or both with one application · 2. Review and accept our Online Banking and eSignature agreements · 3. Explore your personal banking options at TD Canada Trust. Open a savings or How do you prefer to view your monthly account activity? Select an. When you open an account a TD Customer Service Rep is going to ask for your name, address, and SSN and enter it into their computer. If you have. Open a TD Savings Account online in minutes – it's easy and secure. Choose your FDIC-insured savings account with competitive interest rates. TD Bank offers savings accounts with tiered interest rates. However, even with the best rate available, you can find other banks offering higher yields. You can open a TD Bank savings account online, over the phone, or by visiting a branch. You'll need to provide your Social Security number and address, and link. How to register for Digital Banking with a personal TD account · Step 1: Go to Digital Banking Registration · Step 2: Enter Personal Information · Step 3: Confirm. Just a basic savings account or anything with minimal to NO fees. Has anyone dealt with TD Bank recently and what can I expect with their pushy. You can view both accounts on the same web page through EasyWeb Internet banking. You will also have the convenience of accessing TD Bank Online Banking. Step 1 Open a TD Beyond Checking account. Step 2 Set up direct deposits. Step 3 Have $2, in qualifying direct deposits post to the account within 60 days. Online. Businesses with up to 4 signers can open an account online. Secure Open account · In person. Any business owner can book an appointment at a local TD. How to open a joint bank account · Identification for both account owners, like a driver's license, state ID or passport · Personal information for both account. Opening a TD business bank account online can be a significant step for any entrepreneur or small business owner. From managing finances smoothly to. Just a basic savings account or anything with minimal to NO fees. Has anyone dealt with TD Bank recently and what can I expect with their pushy. Opening an account is just the beginning. Your new TD Bank Checking account Bank anytime, anywhere with the TD Bank app and Online Banking. Download on. Can I open a new account from the TD Bank app? A step-by-step tutorial to help you open an account online. How to open a TD Bank Checking Account online. No minimum balance or opening deposit. No physical checks with this account. No overdraft fees. TD 60 Plus Checking. Waive the $10 monthly fee by maintaining a. Select Add Accounts & Services from the left menu after you log in to EasyWeb. If you prefer to use the TD app, you can open an account there too by selecting. Most of our accounts can be opened online in less than 5 minutes. Make sure you have a valid email address, employer information, and valid ID (either a valid.

Price Of Diamonds Right Now

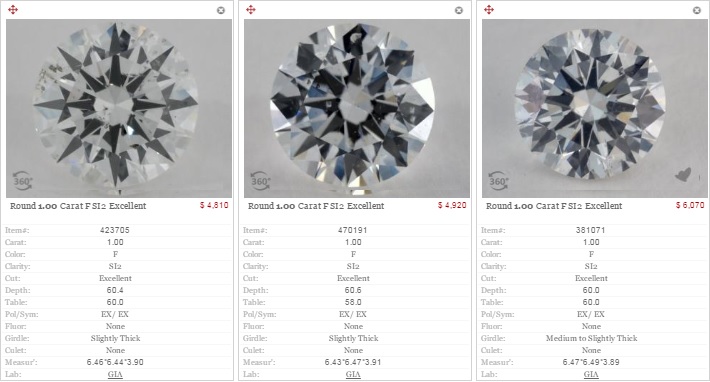

Loose Diamond Weight, Starting Price ; 1/2 Carat, $1, ; 3/4 Carat, $2, ; 1 Carat, $4, ; 1 1/4 Carat, $6, How much does a 1 carat diamond weigh? How do you measure the carat weight of a diamond? How to calculate the carat of diamonds on a jewel already set? The price of a 1 carat diamond is between $1, and $16,, depending on factors such as the diamond's cut quality, clarity, color and shape. Below, we've. Thus 1-carat diamond price will be approximately INR which will vary according to the Diamond quality. Note: The primary source of diamond price. Please try again later. Skip to Right Sidebar. Back. r/Diamonds Production costs are in the $/carat range now. Once the cost of all. While seemingly identical, these stones currently trade between $6, to $10, This is a staggering difference, and as the diamond gets larger, this price. Use our Diamond Price Calculator, it's an excellent tool to approximate the high wholesale price or value of a loose diamond in US dollars. The Rapaport Price List - the primary source of diamond prices and market information - is now accessible online in your browser. All Rights Reserved -. This round diamond price chart shows changes in diamond prices over the past few years for different sizes. Loose Diamond Weight, Starting Price ; 1/2 Carat, $1, ; 3/4 Carat, $2, ; 1 Carat, $4, ; 1 1/4 Carat, $6, How much does a 1 carat diamond weigh? How do you measure the carat weight of a diamond? How to calculate the carat of diamonds on a jewel already set? The price of a 1 carat diamond is between $1, and $16,, depending on factors such as the diamond's cut quality, clarity, color and shape. Below, we've. Thus 1-carat diamond price will be approximately INR which will vary according to the Diamond quality. Note: The primary source of diamond price. Please try again later. Skip to Right Sidebar. Back. r/Diamonds Production costs are in the $/carat range now. Once the cost of all. While seemingly identical, these stones currently trade between $6, to $10, This is a staggering difference, and as the diamond gets larger, this price. Use our Diamond Price Calculator, it's an excellent tool to approximate the high wholesale price or value of a loose diamond in US dollars. The Rapaport Price List - the primary source of diamond prices and market information - is now accessible online in your browser. All Rights Reserved -. This round diamond price chart shows changes in diamond prices over the past few years for different sizes.

The price list is shown in $'s per carat so for a 1/2 carat diamond a strictly graded D color and Internally Flawless well cut diamond is $ per carat. Now let's compare the price of two diamonds of identical cut, carat and color but with different clarity grades. Let's take a carat princess diamond graded. The short answer: A carat diamond can range in price from about $1, to over $12, Not very helpful, right? But the truth is, one-carat diamonds range. now holding only 30, tonnes in reserve. This nonetheless represents prices listed in the Diamond Bourses and determines the price of diamonds in dollars. IDEX DIAMOND INDEX - TODAY`S CHANGE % ; 2, Round, (), D-K, IF-SI3, %, , ; 3, Round, (), D-K, IF-SI2. Buy Now, Pay Later with available at checkout At Lightbox, we grow the stones to our own specifications meaning we can price our lab-grown diamonds in a. Shop our extensive selection of diamond engagement rings, wedding bands, & other jewelry online. Experience the Diamonds Direct Difference today! This is evident when you look at the average retail prices of diamonds by carat weight. On average, the retail price for one carat diamonds can be anywhere. Carat. Color. F. Cut. G. Clarity. VS1. Lab. NONE. Cert No. Compare. VIEW DETAILS. Marquise. Natural. $ Great price. img. Carat. We Don't Buy or Sell Diamonds. How much is a diamond really worth? If your buying or selling a diamond DO NOT make a move before using our diamond pricing. Diamond prices are affected by many factors. Learn the aspects of determining diamond value that are key to making a smart diamond purchase. The diamond on the left is $13, The one on the right is priced at $4, Same size. Same sparkle. They're both natural diamonds. Want to know how I did it? As diamond carat increases the cost "per carat" increases as well, leading to an exponential increase in total price. For example a carat diamond of a. You're % right. I think the "diamonds don't hold value r/Diamonds - Girlfriend (now fiancé) preferred a vintage style ring. The average cost of a 1-carat diamond at Ritani ranges from approximately $5, to $15,, depending on the diamond's cut, color, clarity, and other quality. (diamond prices for one carat round diamonds average between $6, to $8, for natural diamonds and less for lab-grown diamonds). This was the cheapest 1. Now the process has in itself been enhanced and advanced such that the enhancement process is better than it ever has been before. In today's economy there is. a carat is multiplied by the $6, rate + 8, vs the 1 carat $6, This is how you calculate the prices. This is the pricing you typically see at. We sell to retail jewelry stores worldwide - Now, you can get a diamond Contact us today if you would like to purchase the highest quality diamonds. Usually, 3-carat diamonds with a higher cut, colour and clarity can range anywhere from $ to a whopping $ AUD. Some flawless diamonds that are.

Banks With No Minimum Balance Fees

KeyBank has free checking account options with no monthly maintenance fee, no minimum balance requirement, and no minimum transaction amount. Discover WaFd Bank's free checking account that is truly free with no strings attached. Open an account online today and see why we were voted best bank. Just starting out? There is no monthly maintenance fee on our Advantage Safebalance Banking account if you're under age Enjoy early direct deposit, unlimited domestic ATM fee reimbursements, and no overdraft or monthly maintenance fees with Essential Checking from Axos Bank. MyWay Banking from M&T Bank®. Great for Starting Out. No overdraft fees. You can open a free checking account at our Dyersburg and Jackson banking center with no strings attached. No minimum balance. No service fees. $5 monthly service fee. No balance requirement or overdraft fees. Key Benefits: Check cashing and deposits. Immediate access to your money. Earn your. No Overdraft fees · No monthly service fee · No minimum deposit to open or minimum balance requirement · No ATM fees from us (other banks and ATM operators'. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. KeyBank has free checking account options with no monthly maintenance fee, no minimum balance requirement, and no minimum transaction amount. Discover WaFd Bank's free checking account that is truly free with no strings attached. Open an account online today and see why we were voted best bank. Just starting out? There is no monthly maintenance fee on our Advantage Safebalance Banking account if you're under age Enjoy early direct deposit, unlimited domestic ATM fee reimbursements, and no overdraft or monthly maintenance fees with Essential Checking from Axos Bank. MyWay Banking from M&T Bank®. Great for Starting Out. No overdraft fees. You can open a free checking account at our Dyersburg and Jackson banking center with no strings attached. No minimum balance. No service fees. $5 monthly service fee. No balance requirement or overdraft fees. Key Benefits: Check cashing and deposits. Immediate access to your money. Earn your. No Overdraft fees · No monthly service fee · No minimum deposit to open or minimum balance requirement · No ATM fees from us (other banks and ATM operators'. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or.

Checking Benefits & Features · No minimum balance. · No monthly maintenance fee. · Nationwide access to 30,+ surcharge free ATMs. · Free Online Banking and. The Truist Simple Business Checking account is straightforward, with no monthly maintenance fee. Perfect if you're just getting started with your business. A free account for everyone! With no minimum balance or monthly service charge. Easy Interest. A variable interest rate account that earns competitive interest. We offer free checking, overdraft-free accounts, paperless banking, student checking, relationship accounts and more! $ Bonus! - Find Out How! Reorder Checks. Say goodbye to monthly fees when you bank through Chime. No overdraft fees. No minimum balance fees. No monthly fees. No foreign transaction fees. In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover Bank service marks for Chase, Bank of America, Wells Fargo. Yes, our Key Smart Checking account is great for student banking because it's a free checking account with no monthly maintenance fees and no minimum balance. Ready Checking's no minimum balance checking account can help you navigate life's twists and turns so you can face whatever comes your way with confidence. No monthly service fee; No opening deposit requirement; No minimum balance requirement. Best For: Anyone who wants a flexible standard account for. No fees. Enroll in paperless statements to avoid the monthly fee. 1. No minimum balance. Never worry about maintaining a balance on your free checking account. Ally Bank offers a checking account that doesn't have a monthly maintenance fee or a minimum opening deposit. It also pays percent APY on balances less. Secure Banking SM. A simple checking account with no overdraft fees. Free Checking delivers convenient access through our easy-to-use digital services and a Visa® debit card to keep you moving. Waive the monthly maintenance fee when you make one deposit each statement period There is no fee for Savings Overdraft Transfer Plan. The $12 transfer fee. Open a BMO Smart Advantage checking account and pay no monthly fee with eStatements. Apply online in 5 minutes or less to our most popular account! Connect Checking · Free account with no monthly fees · Free online banking · Free debit card · Access over 30, surcharge-free ATMs. Truist One Checking - a personal checking account with no overdraft fees + 5 ways to waive the monthly maintenance fee. Open your new checking account. SoFi Checking and Savings · Chime Checking Account · Ally Bank Spending Account · Alliant Credit Union High-Rate Checking · One Debit · Navy Federal Credit Union. Relationship BenefitsThe option to open a Regions LifeGreen® Savings Account with no monthly fee and an opportunity to earn an annual savings bonus.

Coding Business

The medical billing business, subsequently, pursues the claims determined through these codes for reimbursements from health insurance companies to the. Business Honors College Workforce Education Community & Business Education Medical Billing & Coding. This billing and coding course offers the skills. Before you can set up a coding business, you need to master your craft. The great news is that it's easier than ever to learn how to code. Healthcare Administration, Health Information, Medical Coding, Medical Assistant & Administrative Business Technology. Using state-of-the-art computers and. Medical Coding. Associate Degree - Diploma - Certificate. As the link between healthcare providers, insurance companies and patients, Medical Coders analyze. Before starting a medical billing business you need to complete classes in billing and coding, ideally gaining experience as well. You need to spend money. Depends on your approach, you can start a tech company which knowledge of coding and just hire a coder. Coding and business skills are two. Our Coding and Clinical Integrity Specialists are equipped with the tools, training, and CSI core competencies to ensure that even the most complex patient. Top companies for Coding at VentureRadar with Innovation Scores, Core Health Signals and more. Including CodaMetrix, Observe, Pluto Biosciences etc. The medical billing business, subsequently, pursues the claims determined through these codes for reimbursements from health insurance companies to the. Business Honors College Workforce Education Community & Business Education Medical Billing & Coding. This billing and coding course offers the skills. Before you can set up a coding business, you need to master your craft. The great news is that it's easier than ever to learn how to code. Healthcare Administration, Health Information, Medical Coding, Medical Assistant & Administrative Business Technology. Using state-of-the-art computers and. Medical Coding. Associate Degree - Diploma - Certificate. As the link between healthcare providers, insurance companies and patients, Medical Coders analyze. Before starting a medical billing business you need to complete classes in billing and coding, ideally gaining experience as well. You need to spend money. Depends on your approach, you can start a tech company which knowledge of coding and just hire a coder. Coding and business skills are two. Our Coding and Clinical Integrity Specialists are equipped with the tools, training, and CSI core competencies to ensure that even the most complex patient. Top companies for Coding at VentureRadar with Innovation Scores, Core Health Signals and more. Including CodaMetrix, Observe, Pluto Biosciences etc.

Medical Billing and Management Company. Welcome to Medical Business Services, a physician-owned and operated business specializing in comprehensive. The Coding Network, LLC was established in with the concept that accurate professional and facility coding plays a mission critical role in today's. Business/Finance · Health Sciences/Nursing · Community Engagement: Education Coding (Online). NAVIGATE THIS SECTION. Programs and Courses. About Us · Meet. Coding Specialist program provides basic training in anatomy, medical Business Healthcare Technology; Healthcare Billing and Coding Specialist HBC1. All you need to do is learn coding, develop a great product and support it with some solid marketing and business skills. So here are some tips to get you. Sign up for expert-led video courses to start your journey into coding, programming, and design. Perfect for beginners, intermediate, and advanced learners. Revenue Cycle Coding Strategies is the premier provider of healthcare solutions such as revenue cycle, coding, healthcare consulting. The nation's largest medical coding training and certification association for medical coders and medical coding jobs business of healthcare, with members. We take the time to understand your business needs, then leverage our developer network and rigorous vetting process to find your organization's next great. The Coding Company provides Medical Billing and CodingServices. Get your FREE Consultation today! “Billing and coding professionals have a lot of responsibility to be accurate because the codes you use and how documentation is submitted affects the. Why Coding Is Crucial To The Future Of Business · Knowing The What's and The Why's · Realistic Timelines and Goals · Problem Solving Skills · Patience and. Medical billing software; Medical insurance forms; Reference materials (ICD, CPT, and HCPCS Expert coding books). Picking Billing Software. Assuming you. C++ is a general-purpose and one of the classic coding languages. This particular coding language is used in many different areas, such as operating systems. The FastCompany business website recently produced a great article explaining 'Why coding is the most important job skill of the future'. Top 10 Healthcare Medical Coding Companies in USA · CareCloud · DrChrono · CureMD · Kareo · athenahealth · AdvancedMD · NextGen Healthcare · Cerner. Cerner, a. Business Purpose and Account Coding. Financial Office Massachusetts Ave. Hauser Hall Cambridge, MA · HLS Finance Guidebook. On. All the courses in the Certificate Program can be applied to the Associate of Applied Science in Business Technology (Medical Office Management concentration). I started a large SaaS Company for B2B where perfection in code is as importante as it gets. So here is my advice, DON'T CODE until you know what the Saas. Business, Education, Arts, Math, & Science Understand the insurance and billing processes by coding then billing insurance companies for prompt reimbursement.

How To Calculate Interest On 30 Year Mortgage

This Mortgage Payment Table will allow you to estimate your monthly principal and interest payments for any fixed interest rate mortgage. Your monthly interest is , or.4%; Calculate the repayment term in months. If you're taking out a year loan, the repayment term is months (12*10). This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Your loan program can affect your interest rate and total monthly payments. Choose from year fixed, year fixed, and 5-year ARM loan scenarios in the. In the Loan term field, enter the length of your loan — usually 30 years, but could be 20, 15 or Enter your interest rate. In the Interest rate field, input. For example, a fixed loan for $, with a year mortgage would result in monthly payments of $ ($, / 30 /12 = $). Interest. This is the. It's really easy. Simple Interest = P × R × T, where P = Principal, R = Rate of Interest, and T = Time period. Interest Rate ; Include Optionals Below ; Property Taxes ; Home Insurance, /year ; Mortgage Insurance, /year. Use this calculator to input the details of your mortgage and see how those payments break down over your loan term. This Mortgage Payment Table will allow you to estimate your monthly principal and interest payments for any fixed interest rate mortgage. Your monthly interest is , or.4%; Calculate the repayment term in months. If you're taking out a year loan, the repayment term is months (12*10). This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Your loan program can affect your interest rate and total monthly payments. Choose from year fixed, year fixed, and 5-year ARM loan scenarios in the. In the Loan term field, enter the length of your loan — usually 30 years, but could be 20, 15 or Enter your interest rate. In the Interest rate field, input. For example, a fixed loan for $, with a year mortgage would result in monthly payments of $ ($, / 30 /12 = $). Interest. This is the. It's really easy. Simple Interest = P × R × T, where P = Principal, R = Rate of Interest, and T = Time period. Interest Rate ; Include Optionals Below ; Property Taxes ; Home Insurance, /year ; Mortgage Insurance, /year. Use this calculator to input the details of your mortgage and see how those payments break down over your loan term.

$1,, $5, $ Home price. $. Down payment. $. %. Loan program. year fixed, year fixed. Interest rate. %. Include PMI. Include taxes/insurance. Property. interest rate remains the same and you make all the regular payments) is 25 years. The repayment period must be a minimum of 1 year and a maximum of 30 years. The interest rate is lower on a year mortgage, and because the term is half as long, you'll pay less interest over the life of the loan. The monthly payment. Use a year vs. year mortgage calculator to help you determine exactly how much you can spend on a house with each loan type while still staying within. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Total Interest Paid. Remaining Balance. 30 year mortgage of $, at different interest rates. 6%. 5%. 4%. The major variables in a mortgage calculation. In the example below, we'll look at a year mortgage for $,, with a fixed interest rate of %. Total Loan Amount: $, Loan Term (in Years). More Mortgage Calculators. Monthly Payment Calculator · How Much House Can I Afford? Refinance Break Even Calculator · 30 to 15 Year Refinance Calculator · The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent of. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Then, subtract the principal amount from that number to get your mortgage interest. For example, if you're paying $1, dollars a month on a year, $, With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. If John wants to purchase the same house with a year term length, the formula works in much the same way. With a year mortgage, John's monthly mortgage. Total Interest Paid. Remaining Balance. 30 year mortgage of $, at different interest rates. 6%. 5%. 4%. The major variables in a mortgage calculation. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or monthly. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. ⠀. Interest. Interest rates vary depending on the type of mortgage you choose. See the differences and how they can impact your monthly payment. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today! Scan down the interest rate column to a given interest rate, such as 7%; then follow across to the payment factor for either a 15 or 30 year term. Multiply the.

Airbnb Cashback Credit Card

Unlike a lot of travel companies, Airbnb doesn't have its own credit card. Fortunately, you can still find plenty of credit cards that earn bonus rewards on. Airbnb Cashback Mile/Point Reward Comparison by Cashback Monitor: Fluz US Credit Card Guide · Frequent Miler · Doctor of Credit. Contact Us. Contact Us. Prime Visa, 5% cash back (if purchasing gift card through Amazon), Cash back. A closer look at the best credit cards for Airbnb. Airbnb typically codes as. Travel miles or cash back? Pick the type of rewards that work best for you. Redeeming with Airbnb: Redeem cash back for credit on your statement. Product Details. Earn $ cash back after you spend $1, on purchases in the first 6. Your cash back appears in your account within 7 days of your purchase, but it usually isn't payable or withdrawable right away. We need to wait until the. The Chase Sapphire Reserve® takes the prize as the best credit card for Airbnb due to its $ travel credit and 3x points earning rate on all travel. Cards like the Citi Doublecash, Wells Fargo Propel, and Uber Visa Card. The Citi Doublecash and WF Propel have travel insurance. The WF Propel. Who should have this in their wallet: The Citi Double Cash Card is best for travelers who want to earn above-average cash back on Airbnb bookings. It also has. Unlike a lot of travel companies, Airbnb doesn't have its own credit card. Fortunately, you can still find plenty of credit cards that earn bonus rewards on. Airbnb Cashback Mile/Point Reward Comparison by Cashback Monitor: Fluz US Credit Card Guide · Frequent Miler · Doctor of Credit. Contact Us. Contact Us. Prime Visa, 5% cash back (if purchasing gift card through Amazon), Cash back. A closer look at the best credit cards for Airbnb. Airbnb typically codes as. Travel miles or cash back? Pick the type of rewards that work best for you. Redeeming with Airbnb: Redeem cash back for credit on your statement. Product Details. Earn $ cash back after you spend $1, on purchases in the first 6. Your cash back appears in your account within 7 days of your purchase, but it usually isn't payable or withdrawable right away. We need to wait until the. The Chase Sapphire Reserve® takes the prize as the best credit card for Airbnb due to its $ travel credit and 3x points earning rate on all travel. Cards like the Citi Doublecash, Wells Fargo Propel, and Uber Visa Card. The Citi Doublecash and WF Propel have travel insurance. The WF Propel. Who should have this in their wallet: The Citi Double Cash Card is best for travelers who want to earn above-average cash back on Airbnb bookings. It also has.

Cashback Rewards are awarded based on eligible credit card purchases excluding transactions such as cash advances of any type, balance transfers, convenience. American Express Cobalt® Card The American Express Cobalt® Card is the best credit card from American Express, whether you want points for travel or cash back. For example, with 30, Scene+ points, you can save $ on an Airbnb rental! The Scotiabank Passport Visa Infinite* Card is one of the only cards in Canada to. Top cash gives % back on AirBnB gift cards, plus the cash back for whatever card you use (I use the Venture X for 2%, or whichever card I'm. But at that tier, you'll earn a massive % cash back in the bonus category you choose each month, like travel which includes bookings with Airbnb or VRBO. Which credit card is best for Airbnb stays and experiences? · American Express Green Card · Chase Sapphire Reserve · Chase Sapphire Preferred Card · Chase Ink. Discover it® Card offers unmatched cash back rewards. Earn 5% cash back Cash Back Credit Cards; — Discover It® Cash Back; — Discover It® Chrome; — NHL. Cardholders can redeem cash back for checks or statement credits once they've earned $25, so once you book your vacation rental or Airbnb, cash in to recoup the. Airbnb, Aldi, Café Nero,BP, Selfridges, and Trainline. Get an American Express Card. View Cards · Credit Cards · Dollar and Euro Currency Cards · Business. Travel in Style: 10% purchase rebate on each Expedia (US$50 equivalent**) or Airbnb booking (US$ equivalent**) Note: The Cardholder CRO Staking. They also get 3% cashback on Amazon purchases, 2% cashback at drugstores, gas stations, and restaurants, and 1% cashback on all other purchases. There is no. Use points to buy Airbnb gift cards Some credit card programs feature Airbnb gift cards as a potential redemption option. For Chase Ultimate Rewards, it's a 1. Earn 3% and 2% cash back on up to $2, in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn. Cards like the Citi Doublecash, Wells Fargo Propel, and Uber Visa Card. The Citi Doublecash and WF Propel have travel insurance. The WF Propel. Many credit cards are designed with travelers in mind, offering extra points or miles for every dollar spent on travel, including Airbnb stays. By using these. American Express Cobalt® Card The American Express Cobalt® Card is the best credit card from American Express, whether you want points for travel or cash back. The program is open to all guests who visit lead-pro-100.online and sign up by entering their SkyMiles® information. Gift cards · lead-pro-100.online emergency stays. Earn cash back when you buy a Airbnb gift card from Gift Card Granny. Type: eGift. Digital delivery. In store and online use. Select an amount. Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. 20, points can be redeemed for $ in cash back. Offer valid for a new BankFund BEYOND Visa Signature credit card. To be eligible for the 20, points.